All Categories

Featured

Table of Contents

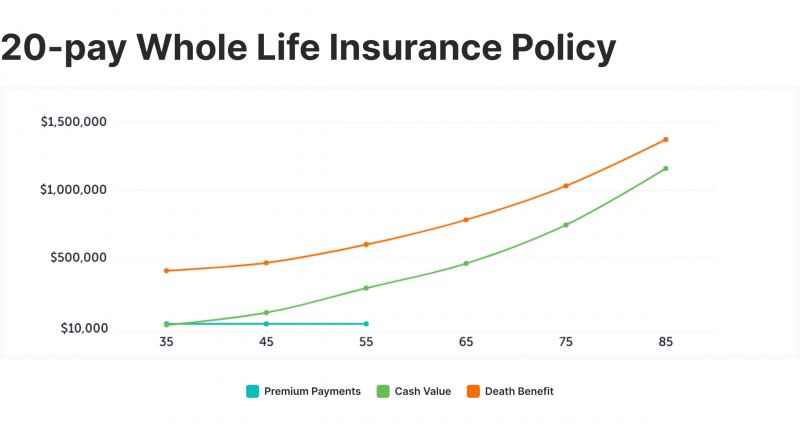

The are whole life insurance policy and global life insurance policy. grows cash value at an ensured rate of interest and likewise via non-guaranteed dividends. grows cash value at a dealt with or variable rate, depending on the insurance firm and policy terms. The money worth is not contributed to the death benefit. Cash money worth is an attribute you capitalize on while to life.

After ten years, the money value has expanded to around $150,000. He secures a tax-free funding of $50,000 to begin a business with his brother. The plan financing rates of interest is 6%. He pays off the lending over the following 5 years. Going this path, the rate of interest he pays returns right into his plan's money value as opposed to a banks.

Envision never ever having to stress regarding bank finances or high passion prices once more. That's the power of unlimited financial life insurance.

There's no set lending term, and you have the flexibility to pick the payment routine, which can be as leisurely as paying off the financing at the time of fatality. This versatility prolongs to the servicing of the fundings, where you can go with interest-only payments, maintaining the finance balance level and manageable.

Holding money in an IUL repaired account being attributed interest can typically be much better than holding the cash money on deposit at a bank.: You've always desired for opening your own bakery. You can borrow from your IUL plan to cover the initial expenses of leasing a room, acquiring equipment, and employing team.

How To Start Infinite Banking

Personal car loans can be obtained from typical financial institutions and debt unions. Borrowing cash on a credit report card is generally really expensive with yearly percentage rates of interest (APR) usually reaching 20% to 30% or even more a year.

The tax obligation therapy of policy finances can vary dramatically depending upon your nation of residence and the specific terms of your IUL plan. In some areas, such as The United States and Canada, the United Arab Emirates, and Saudi Arabia, policy car loans are generally tax-free, using a substantial advantage. In other territories, there may be tax obligation effects to think about, such as possible tax obligations on the financing.

Term life insurance only offers a fatality benefit, without any type of cash money value build-up. This implies there's no cash money value to borrow versus. This article is authored by Carlton Crabbe, Chief Executive Officer of Capital for Life, a professional in giving indexed universal life insurance policy accounts. The information provided in this write-up is for educational and informative functions just and should not be interpreted as monetary or financial investment recommendations.

Alliance Privilege Banking Visa Infinite

When you first listen to about the Infinite Financial Idea (IBC), your first response might be: This sounds as well great to be true. The trouble with the Infinite Financial Concept is not the idea but those individuals providing a negative review of Infinite Financial as a principle.

So as IBC Authorized Practitioners via the Nelson Nash Institute, we assumed we would respond to some of the leading inquiries individuals search for online when finding out and recognizing everything to do with the Infinite Banking Concept. So, what is Infinite Financial? Infinite Financial was developed by Nelson Nash in 2000 and totally discussed with the publication of his book Becoming Your Own Banker: Unlock the Infinite Banking Principle.

Rbc Private Banking Visa Infinite Card

You assume you are appearing monetarily in advance because you pay no interest, yet you are not. When you conserve cash for something, it typically implies giving up another thing and reducing on your lifestyle in other locations. You can duplicate this process, but you are simply "shrinking your means to riches." Are you happy living with such a reductionist or scarcity mindset? With conserving and paying cash money, you might not pay interest, however you are utilizing your money as soon as; when you invest it, it's gone forever, and you surrender on the chance to make life time compound passion on that cash.

Also banks utilize whole life insurance for the very same objectives. The Canada Revenue Company (CRA) also recognizes the worth of taking part whole life insurance coverage as an unique possession class utilized to generate long-term equity safely and naturally and give tax advantages outside the scope of typical financial investments.

Td Bank Visa Infinite Card

It enables you to produce riches by fulfilling the financial function in your very own life and the ability to self-finance major way of life acquisitions and costs without disrupting the substance interest. One of the most convenient means to think of an IBC-type participating entire life insurance policy policy is it approaches paying a home loan on a home.

Over time, this would certainly produce a "constant compounding" impact. You understand! When you obtain from your taking part entire life insurance policy policy, the money worth remains to grow continuous as if you never ever obtained from it to begin with. This is because you are utilizing the money value and fatality advantage as collateral for a loan from the life insurance policy company or as security from a third-party loan provider (known as collateral lending).

That's why it's imperative to deal with a Licensed Life Insurance Broker accredited in Infinite Banking who frameworks your participating whole life insurance plan appropriately so you can prevent negative tax effects. Infinite Banking as an economic technique is except everyone. Here are a few of the pros and disadvantages of Infinite Banking you must seriously think about in deciding whether to progress.

Our favored insurance coverage service provider, Equitable Life of Canada, a mutual life insurance coverage firm, concentrates on getting involved entire life insurance coverage policies details to Infinite Financial. Likewise, in a mutual life insurance policy business, insurance policy holders are thought about firm co-owners and obtain a share of the divisible surplus produced every year via returns. We have a variety of providers to select from, such as Canada Life, Manulife and Sun Lifedepending on the demands of our clients.

Please also download our 5 Top Inquiries to Ask A Boundless Banking Representative Prior To You Employ Them. For additional information concerning Infinite Banking go to: Please note: The product given in this e-newsletter is for informative and/or educational objectives just. The details, viewpoints and/or views revealed in this newsletter are those of the authors and not necessarily those of the distributor.

How To Become My Own Bank

Nash was a finance specialist and follower of the Austrian college of economics, which advocates that the value of items aren't explicitly the outcome of standard financial frameworks like supply and need. Rather, individuals value cash and goods in a different way based on their financial standing and demands.

One of the challenges of typical financial, according to Nash, was high-interest rates on finances. As well many individuals, himself consisted of, got right into monetary trouble due to dependence on financial institutions.

Infinite Banking requires you to possess your monetary future. For goal-oriented individuals, it can be the finest monetary tool ever. Below are the advantages of Infinite Banking: Perhaps the solitary most helpful aspect of Infinite Banking is that it improves your money circulation.

Dividend-paying whole life insurance is extremely reduced risk and supplies you, the insurance policy holder, a fantastic deal of control. The control that Infinite Banking offers can best be organized right into two classifications: tax benefits and possession securities.

Entire life insurance coverage policies are non-correlated properties. This is why they function so well as the financial foundation of Infinite Financial. No matter of what occurs in the market (stock, genuine estate, or otherwise), your insurance policy keeps its well worth.

Whole life insurance coverage is that 3rd container. Not only is the rate of return on your whole life insurance policy guaranteed, your death advantage and costs are also ensured.

What Is Infinite Banking Life Insurance

This structure straightens completely with the principles of the Continuous Wealth Method. Infinite Banking attract those looking for better financial control. Right here are its major benefits: Liquidity and availability: Policy car loans offer instant accessibility to funds without the constraints of standard bank lendings. Tax effectiveness: The cash worth expands tax-deferred, and policy finances are tax-free, making it a tax-efficient tool for developing wide range.

Property defense: In numerous states, the cash money worth of life insurance policy is shielded from creditors, adding an extra layer of economic security. While Infinite Banking has its qualities, it isn't a one-size-fits-all solution, and it comes with significant downsides. Here's why it might not be the very best strategy: Infinite Banking frequently calls for elaborate plan structuring, which can perplex insurance holders.

Latest Posts

Infinite Banking

Comment Byob To Learn How You Can Become Your Own Bank

Nelson Nash Life Insurance